Let’s discuss the fundamentals to consider before you invest in a stock market and how to invest in the market of stocks. Decide on how to invest in stocks: You can discover a wide variety of ways to invest in…

Read MoreStock market is popular as the place of potential to invest cash. It is also risky to invest which makes the people's attention to draw towards the losses and huge gains. If you are going to maintain the risk then…

Read MoreIn recent days, many of the people invest in stock markets for acquiring huge profits. stock market is right place to invest money, make decisions, and with risks is the stock market. If you are thinking to invest in the…

Read MoreThe stock market is an investment vehicle that has existed since the 1800s. Businesses around the world issue large amounts of shares to the general public for various reasons, mainly to raise funds for expansion of their company. Stock exchanges…

Read MoreWhat is Repo Rate? Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds. Repo rate…

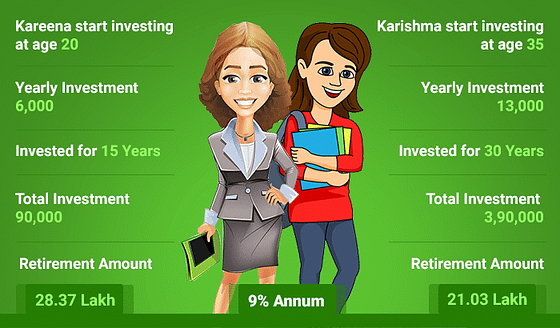

Read MoreCompound interest is the eighth wonder of the world. He who understands it...earn it. He who doesn’t... pay it.” Albert Einstein. As the above quote of great scientist explains the value of compounding itself. The general definition of compounding is…

Read MoreForget revenue and profits, the largest eCommerce firms seem to believe the height of Burj Khalifa is a fair metric to measure their performance during the holiday season. Yes, that’s true! And these largest eCommerce firms are none other than,…

Read MoreEveryone wants to multiple their money as soon as possible. There are mainly some limited options available in the market i.e. Fixed Deposit, Property and Stock Market to invest and earn returns on it. Bank Fixed Deposit, Corporate Fixed Deposit,…

Read MoreIf you buy a life insurance policy, the insurance company promises to pay you an amount at least equal to the life risk cover you have taken on the event of your unfortunate death. The company would be liable to…

Read MorePrice to earning ratio(P/E) is ratio which can calculate by company current share price divided by company earning per share(EPS). Formula to calculate P/E Ratio: P/E Ratio = Company stock current market price / Earning per share Example: Suppose current…

Read More