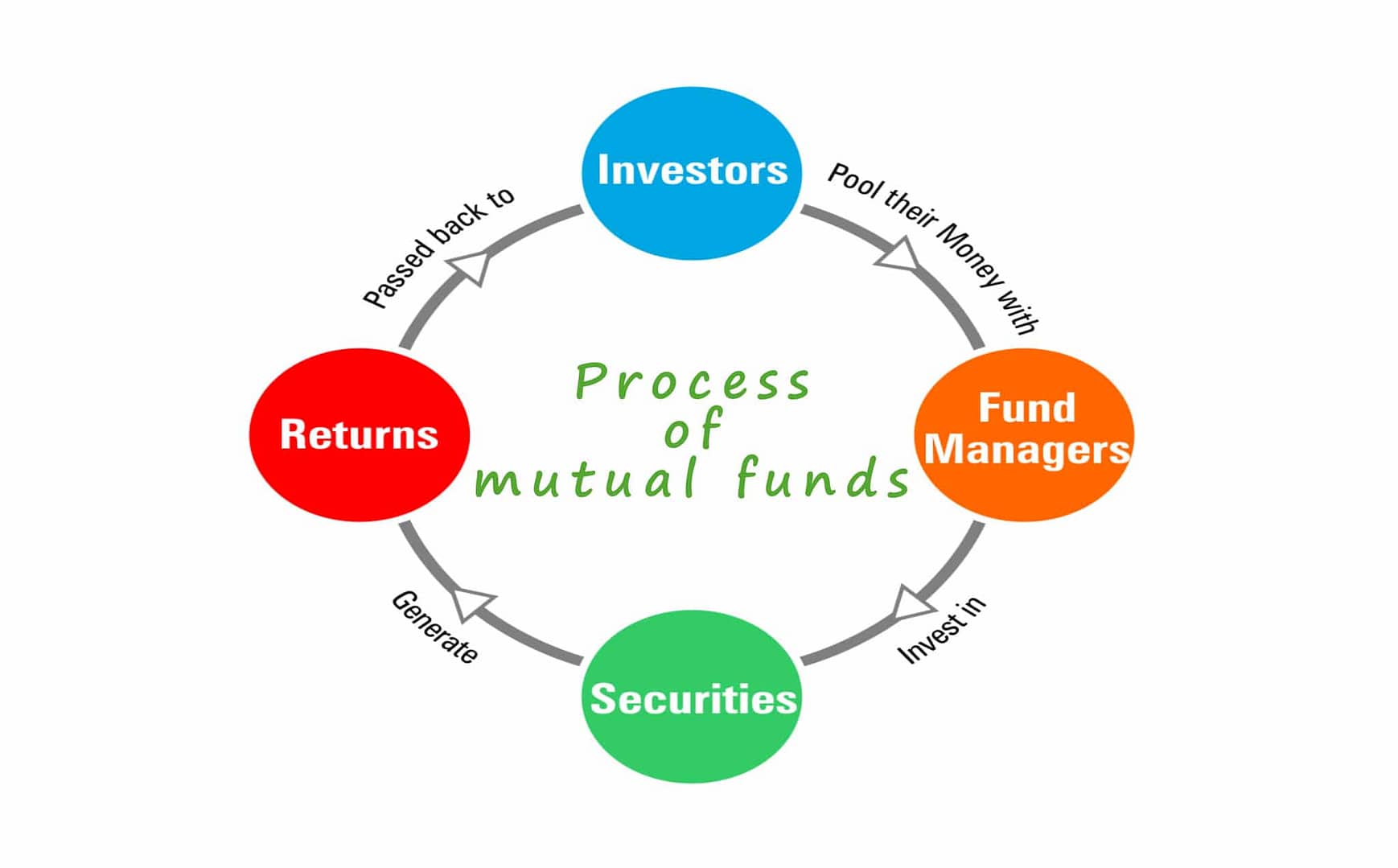

A mutual funds is a group of investments of investors money in stocks share market, securities funds, bonds etc.

Mutual funds always managed by professional fund manager who has deeply watch on market situations and always try to give the good invest of returns to investors and cut the risk rewards of investors money.

In a mutual funds lots of investors invest money then on the behalf of investors investment a mutual fund divided in equal parts as that part we called unit.

For an example a group of investors want to buy a land or other property and price of this property is Rs.10 Lakh. Now if we will divide this investment in the unit of Rs. 100 then a 10,000 units will be create then a investors can buy a number of units per own investments. if you want to invest Rs. 1000 thousands of rupees then you can buy 10 units.

What should in your mind before invest in mutual funds:

Before the investment investors should always keep four things in a mind.

1. Past performance: As you know no one can’t predict future performance of fund but we can check the past performance of fund and on the behalf of past performance we can easily decision of investment in fund.

2. Fees: All mutual funds charge a little fee for managing your investment. a fee of fund will be charge as per your investment which will cut your investment.

3. Buy or Sell Price: You buy mutual funds at the fund’s current net asset value (NAV) with addition to other sales charges. Mutual funds are redeemable – you can sell your mutual funds at the current net asset value with less any expenses and charges for recovery.

4. Risk Reward: Mutual is subjective to market risk. The level risk and your investment depends on what funds type you invest in.

Where to buy mutual funds:

1. By mutual fund companies official site

2. By net banking account or directly from the banks

3. Mutual funds dealers

4. Investment firms

5. Life insurance companies